by Ernest Ludwick

At least a dozen states have introduced legislation to implement or at least study the concept of creating an emergency currency to serve as a medium of exchange should there be a breakdown of the federal government’s currency or their ability to distribute it to the states. Could this work? Some examples:

At least a dozen states have introduced legislation to implement or at least study the concept of creating an emergency currency to serve as a medium of exchange should there be a breakdown of the federal government’s currency or their ability to distribute it to the states. Could this work? Some examples:

— Texas, which receives 1/3 of state revenue from the federal government and has many dependent retirees, is considering a “Self Sufficiency Act” to keep goods and services flowing.

— Virginia is authorizing a commission to study the use of gold and silver currency.

— Utah has already authorized the use of gold and silver money.

— Wyoming is considering an alternative currency in the event the US dollar becomes useless.

— Other states have included in their disaster preparedness plans various forms of replacements for federal money in the event of a political or economic meltdown.

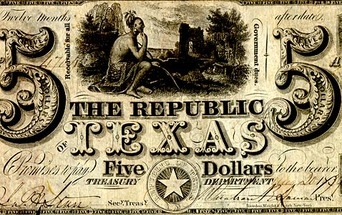

There are serious legal and/or constitutional issues involved in making one’s own money. The Constitution originally only authorized states to create gold and silver coins as money (maybe because the Revolution was financed with what became worthless, un-backed, paper “continentals”). Article I, Section 10, says, “No State shall … emit Bills of Credit ….” (paper intended to circulate as money but not redeemable in gold and silver). Another part of the same Article reads, “No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts …” We soon began to print gold-backed dollars to augment our gold and silver coins. Legal tender laws later allowed unredeemable paper to circulate as money. The first dollar notes were printed in 1792 but by 1862 we switched to fiat dollars to finance the Civil War. Since then, the U.S. has returned to gold-based money several times only to abandon it in favor of paper notes during every major war.

Before standardized bank note “dollars,” there were many privately issued kinds of paper money. Lightweight, portable, standardized U.S. dollars came to predominate despite resistance. Madison and the other framers of the Constitution were deeply concerned not with states’ independent currencies but with the threat of un-backed notes that they had seen used to enrich despots and ravage economies elsewhere.

The un-backed paper push was led by commodities brokers in the 1800s that saw that their markets would give the appearance of constantly rising as long as more dollars were being created. Things haven’t changed much — today’s securities brokers enjoy the same benefit of apparent prosperity in our stock markets due to the huge influx of “funny money.”

The unfortunate dependency on ever increasing rates of return in our pensions, investment portfolios, and in credit-financed government handouts has made our thirst for more and more inflation insatiable. As the ruler elite came to realize, this could not be sustained forever. But instead of acting to stem the flood of red ink, our Congress and several presidencies took the cowardly way out and sacked the Treasury to buy favor and enrich their cronies. Executive Order 6102, enacted during the Depression, aimed to limit private gold ownership to prevent hoarding. It has since been abused by the most notorious limiter of metal as money, Richard Nixon, who enacted the latest decoupling of dollars from gold in order to finance war and curb the drain of gold from the U.S. by speculators.

Inflation becomes real against the fixed measuring stick of bullion. Unlike the times when coins were part of everyday commerce a modern 2.3 gram dime made of gold would today have a value of $150. Easy to buy a cart of groceries but you’d need a coin the size of a pinhead if you wanted to just grab a gallon of milk.

At today’s price the U.S. owns about 2 cents of gold for every dollar in circulation. This, some states feel, leaves us very vulnerable to a precipitous drop in the value of our paper money. Ignoring abstract currency reserve considerations and other assets contributing to U.S.’ solvency this implies no real-world floor of support for the dollar until it reaches a devaluation of 1/50 its current buying power ($100 for a loaf of bread).

So in the event of a global loss of faith in dollars, a back-up system makes sense. But with all of these limits on state and private issuance of money, how are they getting away with these emergency acts? Most of the state measures set up “studies” or “commissions” or “emergency plans,” so no unlawful issuance of money will actually take place until the emergency kicks in.

Utah’s law limits the use of gold and silver as currency to federally minted coins but importantly they can be exchanged at their intrinsic value rather than their face value. They plan to follow up with a law allowing foreign coins to be treated similarly, possibly paving the way for acceptance of coins minted by other states?

As Ron Paul famously pointed out in the 2012 debates, you could buy a gallon of gas for one silver dime ($4.00 then, now worth $5.00 apiece at bullion price). In Britain, pound coins are used for many larger purchases. It’s not that impractical to trade in metal money especially when the paper alternative offers no way to know from day to determine its worth. My Argentine friends tell stories of how shopkeepers would add zeros to the numbers on the money with felt tip pens to keep up with government proclamations.

The threat of severe inflation or hyperinflation is real and in the opinion of many prestigious economists inevitable. If a state’s seismologist gave a warning of a 50%-60% likelihood of an imminent earthquake or tsunami the state would be remiss (and liable) if they failed to create emergency preparations. It appears that the Constitution trumps some of the later Tender Acts.

As a practical matter, the preparation of a money system based on scrip, coin, vouchers, or even a state currency has many precedents. The “state currencies movement” is not a form of protest like the secession movements that popped up following the recent election. It is a wise protection of the states’ citizenry against having their economy reduced to a Stone Age barter system if the federal system fails.